Debt-laden Thames Water has announced it has enough cash to fund its operations until the end of May next year, but efforts to raise new money are ongoing. The UK’s largest water company, which is under scrutiny regarding its survival, reported its debts had risen to £15.2bn in the year to March.

Financial and Environmental Challenges

Rising Debts and Criticism

Thames Water has faced severe criticism for its environmental record, with the number of sewage discharges more than doubling last year. The water regulator Ofwat is expected to publish its draft ruling on how much water companies can charge their customers for the next five years later this week.

Potential Government Takeover

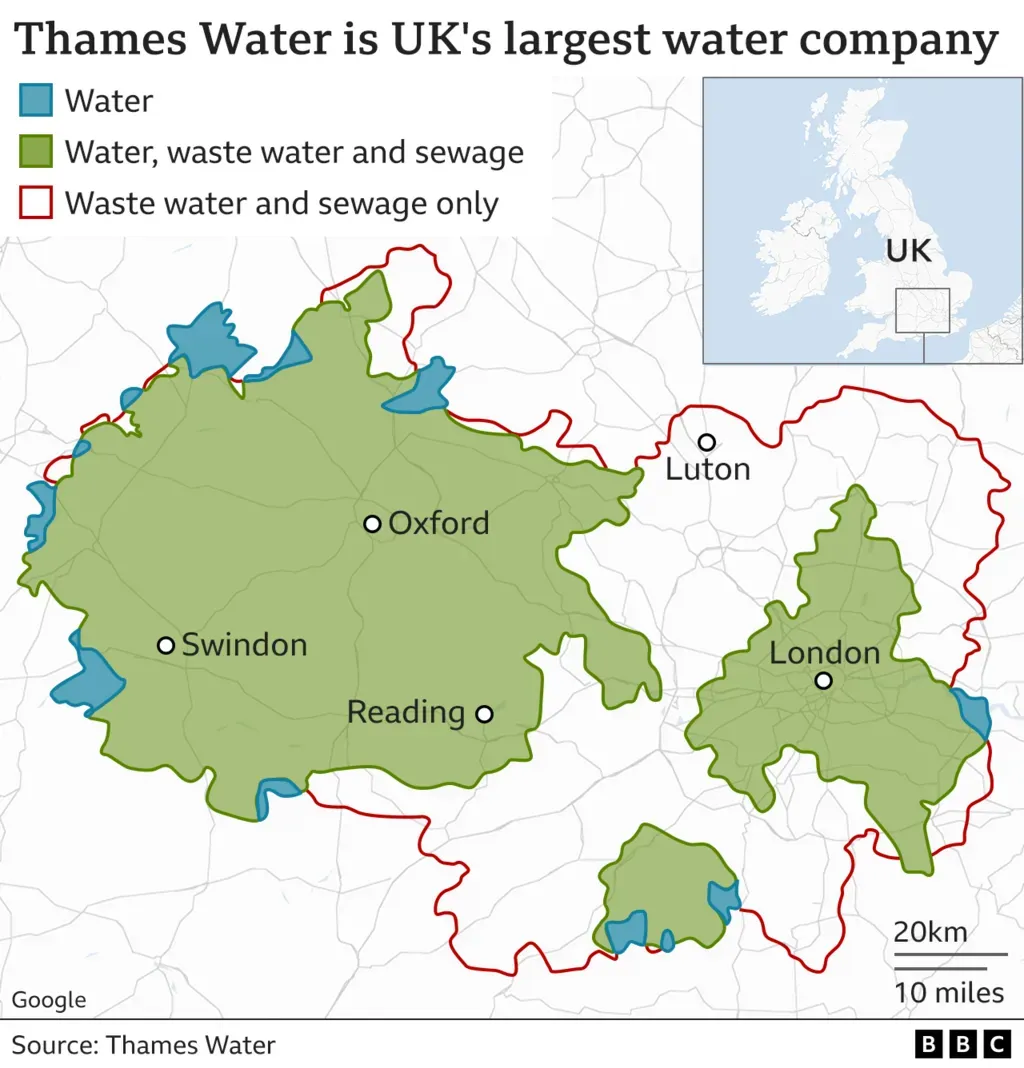

Speculation suggests Thames, serving 16 million customers in London and the Thames Valley region, might need a government takeover if it runs out of money. The company claims it has funding of £1.8bn, sufficient until May 2025. Despite an increase in annual profits to £157.3m, CEO Chris Weston highlighted the urgency of strengthening the company’s financial position.

Proposed Consumer Bill Increase

Thames Water seeks permission from Ofwat to raise consumer bills by up to 44% between 2025 and 2030, promising extra funds for environmental investments. The regulator will release its initial ruling on Thursday, followed by several months of negotiations before a final decision in December.

Negotiations with Investors and Lenders

Thames Water plans to engage with potential investors and lenders following Ofwat’s draft ruling, but this is not expected to conclude until after the regulator’s final decision. An earlier proposal was rejected by the regulator, leading to questions about the company’s future as shareholders at parent firm Kemble Water withdrew a proposed cash injection.

Environmental Performance Concerns

Sewage Discharges and Water Leaks

Thames Water has been criticized for the number of sewage discharges and water leaks affecting its customers. The number of sewage discharges rose to 16,990 last year from 8,015, attributed to “prolonged heavy rainfall.” A 40% increase in rain from the previous year also led to a rise in reportable pollution events to 350 from 331. However, Thames Water reported a 7% reduction in leakages, reaching its lowest ever level.

Impact on Water Quality

Marlene Lawrence, founder of the swimming group Teddington Bluetits in south-west London, emphasized the importance of water quality in the River Thames. She stated that the river’s pollution affects various water groups, including canoe clubs, and the quality of the water is crucial for activities such as rowing and canoeing.

Dividends and Future Outlook

Dividend Payments

Thames Water’s results revealed it paid two dividends worth £158.3m to its holding companies in March this year. Chief Financial Officer Alastair Cochran explained these payments were top-up payments to pension schemes, consistent with normal practice.

Potential Nationalization

In March, CEO Chris Weston suggested nationalization could be possible for the firm. However, he believes a market-led solution that increases financial resilience is in the best interests of all stakeholders. Communities Minister Jim McMahon stated there was no nationalization program for the water industry but assured there is always a contingency plan in place for water supply.

Special Administration Regime

If Thames Water comes under government control, it may be placed into a Special Administration Regime, where financial consultants would manage the company on the government’s behalf. A precedent for this was set in 2021 when energy company Bulb went bust and was placed under special administration. Regardless of Thames Water’s future, water supply to its customers will continue as usual.

FAQ

What is the current financial situation of Thames Water?

Thames Water has reported a debt of £15.2bn as of March and has enough cash to fund operations until the end of May next year.

How is Thames Water planning to raise funds?

Thames Water is seeking to raise consumer bills by up to 44% between 2025 and 2030 and plans to engage with potential investors and lenders following Ofwat’s draft ruling.

What environmental challenges is Thames Water facing?

Thames Water has faced criticism for its environmental record, particularly the increase in sewage discharges and water leaks. The number of sewage discharges doubled last year due to prolonged heavy rainfall.

What are the potential future outcomes for Thames Water?

There is speculation that Thames Water might need a government takeover if it runs out of money. If this occurs, it could be placed into a Special Administration Regime, where financial consultants would manage the company on the government’s behalf.

Will water supply to customers be affected?

Regardless of what happens to Thames Water, the supply of water to its customers will continue as normal.