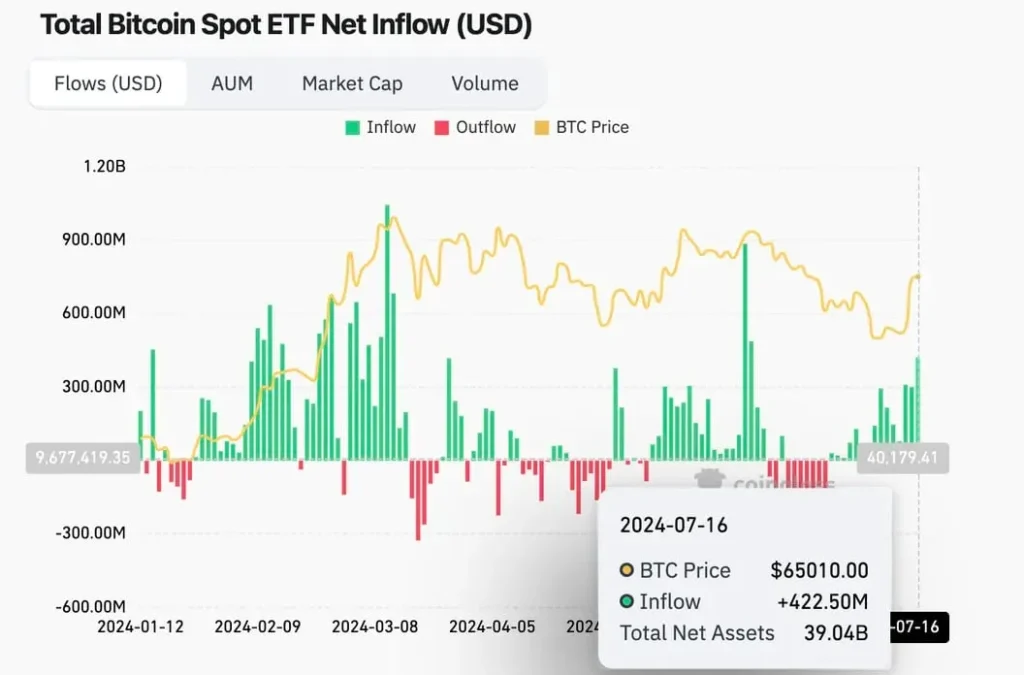

Bitcoin exchange-traded funds (ETFs) have witnessed a resurgence in demand, reaching a six-week high in inflows. The price of Bitcoin has rebounded significantly, showing a 23% increase since its recent low of $53,500 on July 5.

Surge in Bitcoin ETF Inflows

On Tuesday, U.S.-listed ETFs that closely track Bitcoin’s spot price recorded a combined net inflow of $422.5 million. This marks the highest single-day inflow since June 5, extending the funds’ seven-day winning streak. The data, tracked by Farside Investors and Coinglass, highlights a renewed investor interest in Bitcoin.

Key Players in the Market

BlackRock’s IBIT ETF led the pack with an inflow of over $260 million, accounting for a significant portion of the total inflows. FBTC followed with $61.1 million, while other funds, except for GBTC, DEFI, and BTCW, each attracted less than $30 million. Over the past three days, these funds have collectively drawn more than $1 billion, reflecting growing confidence in Bitcoin’s price outlook.

Factors Contributing to Bitcoin’s Price Recovery

Bitcoin’s price has surged to $65,800, driven by several factors in addition to the ETF inflows. A significant factor is the reduced selling pressure from Germany’s Saxony state, which has contributed to stabilizing the market. Furthermore, political developments in the United States have played a role.

The possibility of pro-crypto Republican candidate Donald Trump winning the U.S. presidential election on November 4 has bolstered market sentiment. Trump’s decision to appoint BTC-holder and Ohio Republican Senator James David Vance as vice president further underscores this trend. Vance, who has been a supporter of Bitcoin and digital assets since 2021, recently circulated a draft version of crypto legislation.

Political Implications for Crypto

Vance’s promotion of crypto legislation while being considered by Trump for the vice presidency highlights the increasing political significance of digital assets. As FRNT Financial noted in its Tuesday newsletter, the development emphasizes how digital asset policy has become integral to the Republican vision for the U.S. economy.

Additionally, Trump’s VP decision is viewed as a strategic choice regarding political succession, given that he can only serve one more term if elected. The crypto community is encouraged by the fact that Trump’s likely political successor prioritizes crypto-friendly legislation.

Market Resilience

The crypto market’s resilience is evident as it aligns with the sustained rally in technology stocks on Wall Street. Reports of renewed creditor reimbursements from the defunct exchange Mt. Gox on Tuesday did not significantly impact Bitcoin prices, showcasing the prevailing optimism in the market.

FAQ

Q: What caused the recent surge in Bitcoin ETF inflows?

A: The surge in Bitcoin ETF inflows is attributed to renewed investor confidence, political developments favoring cryptocurrencies, and the reduction of selling pressure from certain market factors.

Q: How much has Bitcoin’s price increased recently?

A: Bitcoin’s price has increased by 23% since hitting a low near $53,500 on July 5, reaching $65,800.

Q: Which ETF recorded the highest inflow?

A: BlackRock’s IBIT ETF recorded the highest inflow, amassing over $260 million on a single day.

Q: What political factors are influencing the Bitcoin market?

A: Political factors include the possibility of pro-crypto Republican candidate Donald Trump winning the U.S. presidential election and his decision to appoint BTC-holder Senator James David Vance as vice president.

Q: How is the crypto market responding to the Mt. Gox reimbursements?

A: Despite reports of renewed creditor reimbursements from the defunct exchange Mt. Gox, the crypto market has remained resilient, with Bitcoin prices staying strong.