President’s Odds Steady Despite Recent TV Appearance

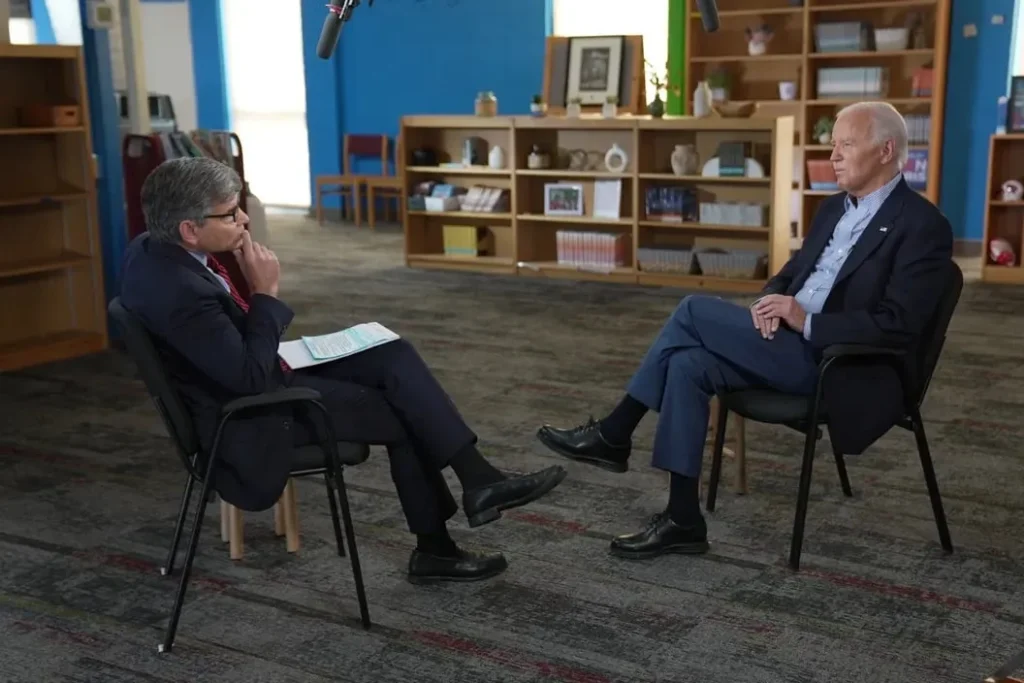

U.S. President Joe Biden’s recent televised interview showed him in a more coherent light compared to his previous debate performance. However, his chances of reelection remain largely unchanged, as reported by traders on Polymarket, a crypto-based prediction market platform.

Polymarket’s Presidential Predictions

Following Biden’s interview with George Stephanopoulos on ABC News, shares predicting his win in the upcoming November election were trading at 11 cents. This represents an 11% probability of Biden securing reelection. These shares saw a slight decrease from their pre-interview price of 12 cents. In this prediction market, each share, priced in USDC (a stablecoin equivalent to the U.S. dollar), pays out $1 if the prediction proves correct, signifying the low confidence in Biden’s reelection among traders.

A month earlier, Biden’s shares were trading at a much higher rate of 36 cents. The significant drop followed his poor debate performance against former President and Republican candidate Donald Trump. In the wake of this, Senator Mark Warner (D-Va.) is reportedly urging fellow Democrats to consider alternative candidates, according to the Washington Post.

Biden’s Nomination and Withdrawal Odds

Polymarket also tracks other related predictions. For the Democratic nomination, Biden’s odds slightly improved by one percentage point to 42% post-interview, with $89 million invested in this contract. Another contract, which speculates on Biden dropping out of the race, saw his chances increase by three percentage points to 65%, backed by $12 million in bets.

Rising Popularity of Political Betting

Polymarket, a four-year-old platform, has seen a surge in activity this year due to the upcoming U.S. election. June marked the first month where the platform surpassed $100 million in trading volume. The platform gained recognition for early indications, through the “Biden drops out?” contract, about concerns over the president’s cognitive health, well before mainstream media coverage.

The Role and Limitations of Blockchain Prediction Markets

Zack Pokorny, an analyst at Galaxy Digital, highlighted the advantages of blockchain-based prediction markets in a recent research note. He emphasized their tamper-resistant, transparent, and global nature, which allows for unfiltered public opinion on various topics. However, he also noted limitations, such as reflecting only the opinions of blockchain users, who might share similar biases, particularly with crypto’s growing political divisiveness.

FAQ

What are Biden’s current odds of reelection according to Polymarket?

Biden’s current odds of reelection are at 11%, as indicated by the trading price of 11 cents per share on Polymarket.

How did Biden’s recent TV interview affect his chances?

The interview did not significantly alter Biden’s chances of reelection, which remained at 11%.

What are the odds of Biden securing the Democratic nomination?

Post-interview, Biden’s odds for the Democratic nomination increased slightly to 42%.

Has there been any change in the probability of Biden dropping out of the race?

Yes, the probability of Biden dropping out of the race increased to 65%, according to Polymarket.

How has Polymarket performed during this election year?

Polymarket experienced its first month exceeding $100 million in trading volume in June, driven by the political betting enthusiasm surrounding the U.S. election.

What are some noted advantages and limitations of blockchain prediction markets?

Blockchain prediction markets are praised for their tamper-resistant, transparent, and global characteristics, allowing for broad public opinion expression. However, they are limited by the relatively small and potentially biased user base active on blockchains.